INVESTMENT PSYCHOLOGY

Why should I Invest?

Warren Buffett — ‘Never depend on a single income. Make investment to create a second source.’

Earnings are the financial blueprint of today’s expenses whereas investments are additional income sources for the future. The objectives of investment are:

- Meet Financial Goals – Financial goals refer to future plans which require a good financing source to accomplish. Investments in securities give you returns on your income and help you mind “money on your money”.

- Overcome Inflation – The inflation rate of the US is at a staggering rate of 7.1%, while the interest rate offered by commercial banks is as low as 0.01% percent.

Unfortunately, while banks provide interest as a passive income source; the money in US bank accounts depreciates at @7.09% on an average/annum! Thus, instead of any increase in the monetary value of saved funds, the value of every unit declines.

- Wealth Creation – Apart from beating inflation and meeting short & long-term financial goals, one of the best roles of investment is to create a wealth corpus for meeting the wants and desires of people. Consistent investments with analytical research can make even a taxi driver a Bugatti owner!

- Tax and Retirement Benefits – Funds like municipal bonds, Tax-free Exchange-traded funds, etc provide tax benefits to investors up to a certain limit.

Moreover, investments made for the long term keep a person tension-free post-retirement.

How can I grow money by Investing?

Let’s take a hypothetical example to understand this better.

There are 2 friends named John and Harry. Both friends decided to begin their careers in investment. Let’s see how each person carries his investment journey.

There are 2 friends named John and Harry. Both friends decided to begin their careers in investment. Let’s see how each person carries his investment journey.

John was very firm about his investment decision and thus, he started to put $10 every month. This was his pocket money amount.

Although in the First few months, he did not get any returns as such and in fact, saw some fall in returns too, still, he was determined. After a few months, he could see the result of consistency. The stock price increased and gave him more than great returns by the end of the year.

On the other hand, when John began his investment journey he wanted to make quick returns. He was excited to see how the price of the stock he invested in, grew after the 1st month. He became greedy and added some more funds. Unfortunately, the market showed its volatility and he saw the fall in his stock price. Thus he withdrew his fund out of panic. He stopped putting any money for 2 months but again the greed influenced him to put money.

The same thing happened again and his impatience heavily tolled on him.

What made Harry’s investment grow and John’s stay volatile?

- Consistency

- Patience

- Discipline

Thus, these are the traits of a successful investor.

The most important quality for an investor is temperament, not intellect.” – Warren Buffet

How do I start Investing?

As we saw before, John was unsuccessful in building wealth because he was not aware of the fundamentals of investing. He made several mistakes in his investment journey which you should keep in account:

- The share market is a deep ocean of money. Make your investment rules and limits and only follow them. Do not get driven by greed or fear.

- Pre-decide your return and risk. Most people lose money in the share market because they do not control their risk. Risk management is the fundamental rule before making any investment. This may not make you profit but will surely save you and your money from LOSS!

- You need not do an in-depth analysis for every company. Sometimes, enough analysis leads to analysis paralysis. Only invest in a business you understand.

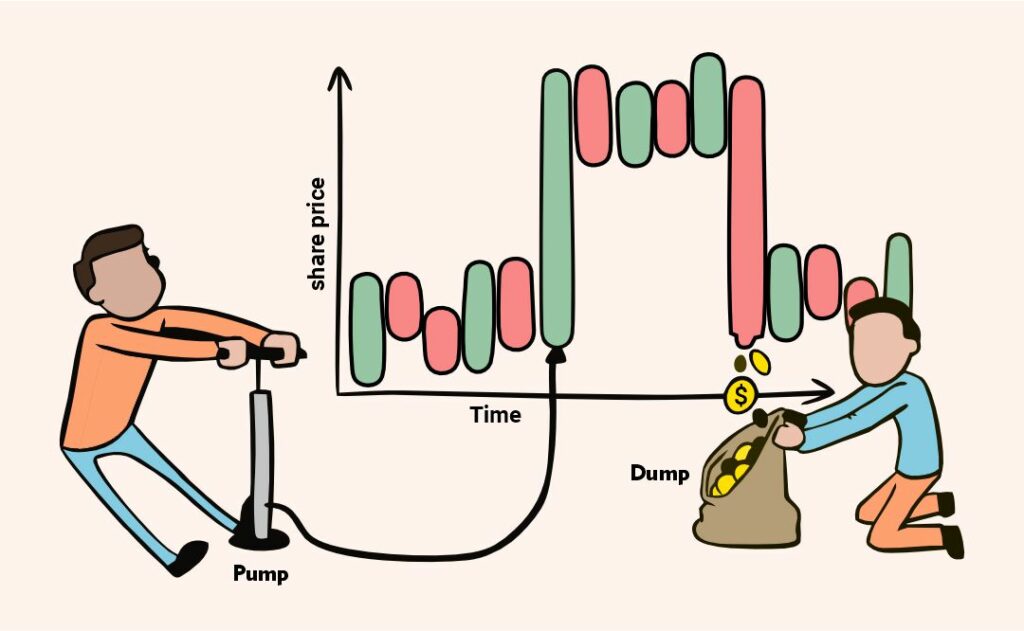

- Never rely on tips and news for investing. These are traps that convince you and many other people like you to push quick buying so that the price of these stocks rises and they can sell their existing securities at a profit. This heavy selling quickly brings the price of shares down, leading to your loss. This is also called the pump and dump scheme.

- Invest Regularly

Roadblocks to Avoid In Your Investment Journey

Power of Compounding

Also referred to as the 8th wonder of the world by Albert Einstein, the power of compounding refers to how the value of money exponentially grows when it consistently gains return.

In this, the interest you earn on the principal amount is re-invested to gain interest on interest.

Let us take the example – John decided to do disciplined investing and thus, he began to put $100 every month in S&P 500. The average rate of return he got ws 10% and he did consistent investing for 18-65 age.

Let us see how much returns he could make by the end of 15 years.

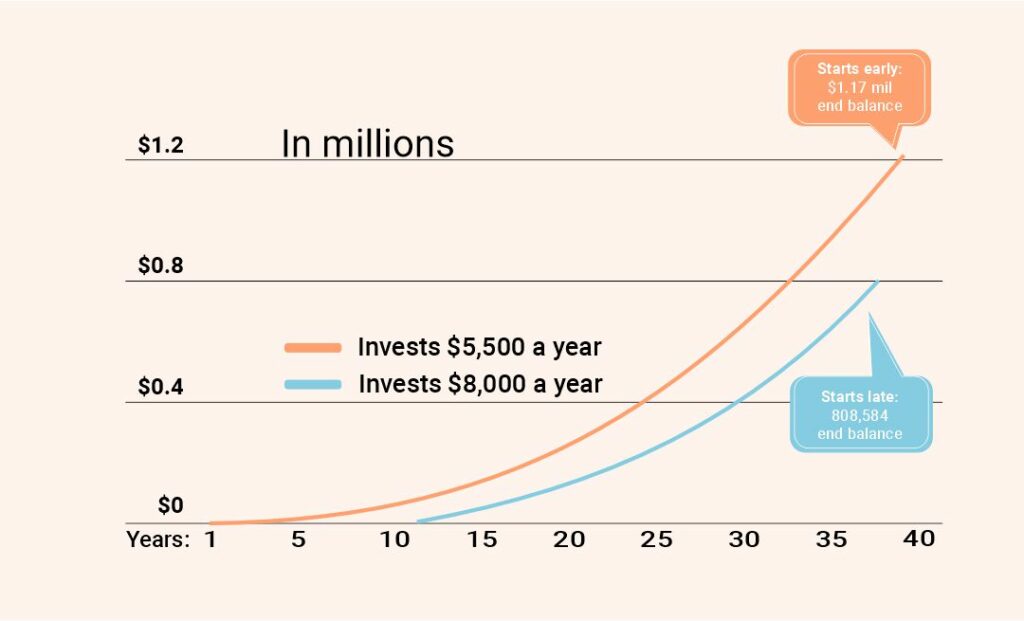

Early Vs. Late Investing

Tortoise and Hare decided to invest. Hare was lazy and too indifferent to start early. However, Tortoise understood the power of compounding and believed in early investing, even if the initial sum was low. Hare started to invest after 10 years of Tortoise journey. Both earned 7% annually. Let us see what is the corpus collected after 40 years (or Tortoise investment).

Myths About Stock Market

When John began his investment journey, he faced many footfalls due to Inconsistent trading, impatience, and lack of financial discipline. Having learnt that and understanding that he needs to rely only on personal research rather than tips and news, he pulled up his socks and re-started his journey.

His family was constantly monitoring his actions and like every stock market-orthodox family, his family had certain myths got strengthened in the initial phase of John’s journey when they saw him losing money and taking mischievous bets.

Below is the conversation between John and his Family and how John tackles them:

John’s Father– We have been constantly following you. You took $1000 for your education and are now burning in the dangerous well of the stock market. Don’t you know it is pure gambling and people lose all their savings and even stake their homes for this? It is an addiction!

John – Father, Gambling refers to those bets whose outcomes are not known or cannot be pre-tested. It is a pure bet – a 50/50 situation.

Whereas, Investment involves tactical analysis of the Fundamentals of the company which talks about the business – its sales, revenue, earnings, and also growth. If I can see the company’s year-on-year growth, then I can invest in the company now to enjoy the fruits of my compounded wealth later.

John’s Mom– But, dear it involves huge bugs to invest in big companies. We cannot afford to give you so much money, especially for those purposes whose benefits are nil at present.

John – Not at all mom. I can start investments with as low as $1. There are many stocks whose market values are less and have not reached their potential price. If I start researching and investing in them, I will not only benefit from capital gains but also from yearly dividends and tax benefits which some stocks provide. Moreover, I can also bet on stocks for a small term to make bugs in less time. However, investment is all about a game of long term which leads to ultimate wealth creation.

John’s Grandfather – But, I feel only experts can find out those multi bagger stocks and can bear that much risk. If you take such an amount of risk and do not benefit from any return then, as there is nothing “guaranteed” in the stock market.

John – It’s not just an expert call. From a 12 year child to an 80-year man, everyone can enter and earn in the stock market. We only need to educate ourselves and do rational research as well as invest in quality stocks. Beginners can initially start investing in blue chip stocks. Those who do not wish to take many risks can deploy funds in large-cap stocks and those who have done handsome research and analysis can take the risk of investing in small-cap stocks and, indeed, find the multi-baggers of tomorrow.

Definitely, nothing is guaranteed in the stock market which is why it is advisable to “diversify” the risk by employing funds to stocks, bonds, and mutual funds.

Mutual funds would ensure financial discipline, stocks would help us gain risky bets (which come with powerful returns) and bonds help us to limit the risk in case of a market crash because of their fixed rate of return.