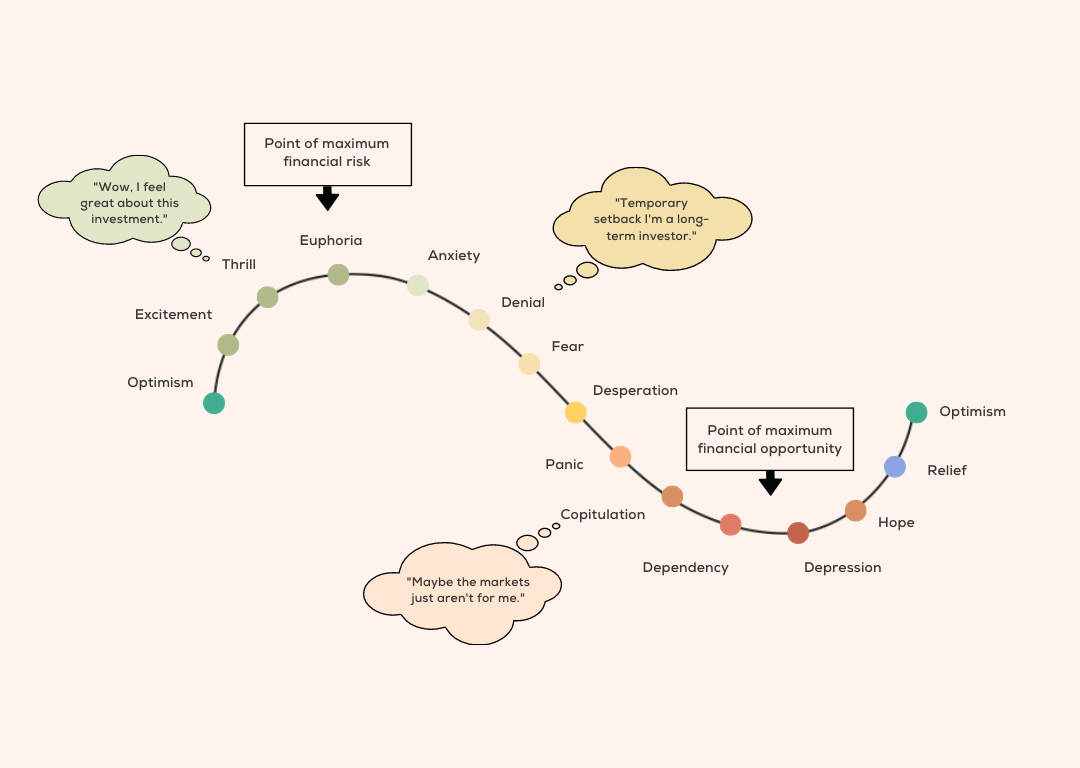

Cycle of Market Emotion

The cycle of market emotion during investing refers to the series of emotional responses that investors experience as the market goes through its ups and downs.

When you take that first step as an investor, you may encounter the full range of emotions described below. Don’t let them overpower you. Be rational and maintain your long-term perspective.

The graph above is a cumulation of 15 psychologies affecting investors’ decision-making.

Let us see what George has to say when he enters the share market.

I was all set to begin my investment journey. I was optimistic about investing all my $10000 in the stock market and excited about making big money and get “super rich super quickly.” I had watched the news about the stocks which were about to rise and also referred to some tips from my friends. The first stock I was about to buy was ABC Ltd which my friend told me to buy at $200. When the market started, it was trading at $198. My prospect theory (behavior during the market) is listed below :

- Optimistic to get rich from the stock market’s heavy earnings.

- Purchased the stock at $198 out of excitement to gain extra 2 dollars

- Was thrilled to see the price movement from $198 to $202 after 2 days.

- Out of euphoria, added some more quantity to make more money.

- Turned anxious on the 3rd day of watching the stock price start that fluctuated between $1900- $170.

- Denied that tip could be wrong and accepted the loss by waiting more, considering it was temporary.

- Felt fearful when the price fell to a drastic $158, $40 loss/ stock!

- Became desperate on the weekend about the price, hoping it to rise.

- When the market opened another week, the price fell further – bringing me into sheer panic and breakdown!

- Finally, when the price fell to $140, it was the maximum fall I could face and decided to sell out of hopelessness.

- The rapid fall in price made me feel more depressed about the losses but gripped me to sell.

- Finally, from $140, the price saw some upturn – a ray of hope.

- The next day, the stock price rallied around 40 dollars, giving me some relief.

- The further rise in price the next day gave me optimism to hold the stock.

Finally, when I lost all my patience, I sold the stock at $190, losing $8 per share. The market experience was horrible as I was running on emotions.

Mostly, negative sentiments take over the market because people “fear” losing money and are “risk-aversive.” Secondly, many investors are of herd mentality and, thus, follow the crowd.

George – My most significant learning was – Emotional investors lose money to rational investors!

Key takeaway

To become a successful investor, a person:

- Must Learn

- Control Emotions

- Manage Risk

- Show Discipline

- Focus Long Term

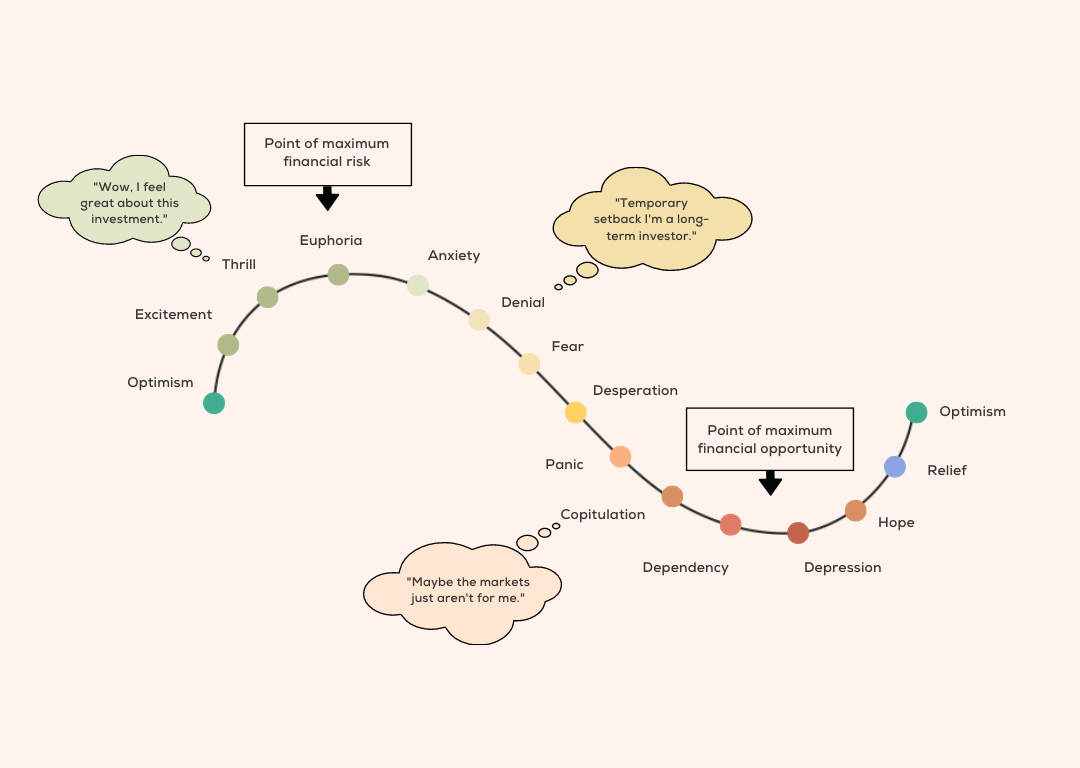

The cycle of market emotion during investing refers to the series of emotional responses that investors experience as the market goes through its ups and downs.

When you take that first step as an investor, you may encounter the full range of emotions described below. Don’t let them overpower you. Be rational and maintain your long-term perspective.

The graph above is a cumulation of 15 psychologies affecting investors’ decision-making.

Let us see what George has to say when he enters the share market.

I was all set to begin my investment journey. I was optimistic about investing all my $10000 in the stock market and excited about making big money and get “super rich super quickly.” I had watched the news about the stocks which were about to rise and also referred to some tips from my friends. The first stock I was about to buy was ABC Ltd which my friend told me to buy at $200. When the market started, it was trading at $198. My prospect theory (behavior during the market) is listed below :

- Optimistic to get rich from the stock market’s heavy earnings.

- Purchased the stock at $198 out of excitement to gain extra 2 dollars

- Was thrilled to see the price movement from $198 to $202 after 2 days.

- Out of euphoria, added some more quantity to make more money.

- Turned anxious on the 3rd day of watching the stock price start that fluctuated between $1900- $170.

- Denied that tip could be wrong and accepted the loss by waiting more, considering it was temporary.

- Felt fearful when the price fell to a drastic $158, $40 loss/ stock!

- Became desperate on the weekend about the price, hoping it to rise.

- When the market opened another week, the price fell further – bringing me into sheer panic and breakdown!

- Finally, when the price fell to $140, it was the maximum fall I could face and decided to sell out of hopelessness.

- The rapid fall in price made me feel more depressed about the losses but gripped me to sell.

- Finally, from $140, the price saw some upturn – a ray of hope.

- The next day, the stock price rallied around 40 dollars, giving me some relief.

- The further rise in price the next day gave me optimism to hold the stock.

Finally, when I lost all my patience, I sold the stock at $190, losing $8 per share. The market experience was horrible as I was running on emotions.

Mostly, negative sentiments take over the market because people “fear” losing money and are “risk-aversive.” Secondly, many investors are of herd mentality and, thus, follow the crowd.

George – My most significant learning was – Emotional investors lose money to rational investors!

Key takeaway

To become a successful investor, a person:

- Must Learn

- Control Emotions

- Manage Risk

- Show Discipline

- Focus Long Term