Why Should I Consider Investing?

Why Invest?

Have you ever wondered how the rich acquired wealth and kept it growing? (-investing)

Do you dream of retiring early?

If you answered “yes,” then you start investing.

Investing is an effective way to put your money to work and potentially build wealth.

The value of the dollar is decreasing every year due to inflation. Investing allows your money to outpace inflation and increase in value. Investing is often described as putting your money to work because the invested capital is used to generate a return over time.

Here are some reasons you can consider starting investing:

- Meeting Financial Goals – Imagine you need 100,000 in 10 years. You can calculate the monthly investment required to reach a goal of $100,000 in 10 years, assuming 8-10% annual rate of return, you need to invest around $550 each month if compounded annually.

Investing can help you stay disciplined and on track to meet your financial goals.

- Inflation Protection – Inflation decreases the value of money over time by reducing its purchasing power. This decrease in purchasing power means that if you hold cash or other assets that do not keep pace with inflation, you will be able to buy fewer goods and services in the future than you could today. The US inflation rate is around 7% in 2022, while the interest rate offered by commercial banks on deposits is around 1%.

Can you imagine, your money in the bank accounts losing its value by 6% every year?

- Long-Term Wealth Creation – The story of Ronald Reid, a Janitor who amassed an $8 million fortune through savvy investments, is a classic example of long-term wealth creation. When Reid passed away in 2014 at the age of 92, his estate was valued at approximately $8 million. Just google his name you will find many inspiring articles.

- Potential for Passive Income: Certain types of investments, such as dividend-paying stocks, can provide a source of passive income that can help supplement your regular income. For example- P&G has been paying a dividend for 132 consecutive years since its incorporation in 1890 and has increased its dividend for 66 consecutive years.

- Tax and Retirement Benefits: Many retirement accounts, such as 401(k)s and traditional IRAs (USA), offer tax-deferred growth, which means that you won’t pay taxes on the earnings until you withdraw the money till retirement. Your money can keep growing for years without paying taxes on gains.

Some investments, such as municipal bonds, also offer tax-free income.

- Provide safety & Peace: No one knows the future, but investing a regular amount of money can also provide a safety net for you and your family in case of emergencies like losing a job. By investing regularly, you can build up a nest egg that can help you cover your expenses if you’re faced with unexpected financial challenges, which will provide you peace of mind.

Why Invest Right Now?

George’s Dilemma: I understood the importance of investing. But why should I start right now? I am young I should live my life to the fullest. I will invest later in my life when I settle down. I have plenty of time to reach my financial goals.

Are you in the same dilemma?

The length of time you invest can significantly impact your returns. Here are a few case studies on why you should start investing now, regardless of your age and money:

Case Study 1-Early Vs. Late Investing

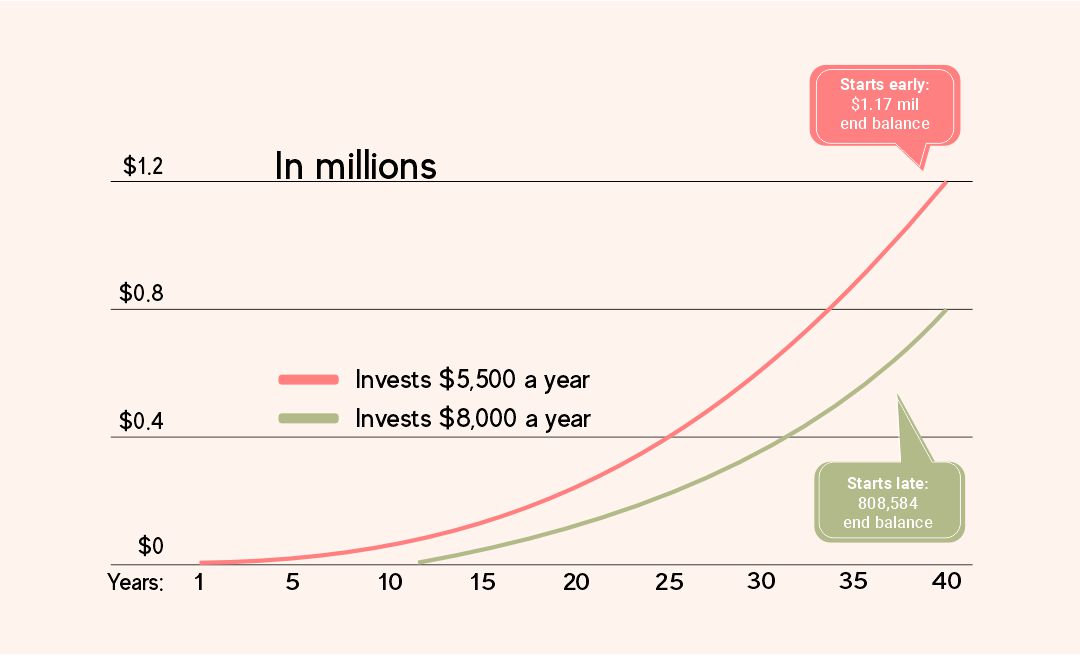

Tortoise and Hare decided to invest. Suppose, Tortoise invested $5,500 per year for 40 years, while Hare started 10 years later and invested $8,000 per year for 30 years. Assuming both earned a 7% annual return, here’s what their investment portfolios would look like after 40 years:

As you can see, even though Hare started with a larger initial investment, Tortoise’s consistent investing over a longer period of time resulted in a higher final portfolio value due to the power of compounding.

Takeaway

it’s never too early to start investing, even if the initial amount is small.

Case Study 2- Power Of Compounding

Compounding allows your money to grow exponentially, as you earn returns not only on your initial investment but also on the returns that investment generates ( interest on interest).

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”

–Albert Einstein

Let us take the example – George started investing at age of 18, he put $100 every month in S&P 500.

The average rate of return he got was 10% p.a., and he continuously invested from 18 to 65 years of age.

Let us see how much returns he could make by consistently investing for 47 years.

Credits – https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

This means if you invest $100 per month for 47 years at a 10% annual interest rate in S&P 500, you would have a total of $1,281,919.73 at the end of the investment period.

Seems unbelievable! This is the power of compound interest – even small, regular investments can make you a Millionaire.

Takeaway

Start early. The power of compounding takes time to work its magic.

Case Study 3- Save vs. Invest

Assuming an annual return of 1% for a savings account in a regular bank and 10% for a stock market S&P investment, here’s how $10,000 invested for 10 years would compare:

- Savings Account: If you save the $10,000 in a savings account at 1% annual interest rate, the money will grow to approximately $12,194.21 after 20 years.

- S&P investment: If you invest $10,000 in the stock market and earn a 10% annual return, the money would grow to approximately $67,275.52 after 20 years.

Calculate With Rule of 72

The Rule of 72 can be a useful tool for estimating the number of years it takes for your money to double based on the annual rate of return.

To calculate the number of years it takes to double your money,

Formula = 72

Return % Per Annum.

The number of years taken by a Savings Account to double

= 72/1

72 years

The number of years taken by a 10% return investment to double

= 72/10

7.2 Years

The above calculation is only considering fix returns, but usually our investment grows with compounded returns.

Takeaway

For comparing investments, calculate how long it takes to double your money.

Why Invest?

Have you ever wondered how the rich acquired wealth and kept it growing? (-investing)

Do you dream of retiring early?

If you answered “yes,” then you start investing.

Investing is an effective way to put your money to work and potentially build wealth.

The value of the dollar is decreasing every year due to inflation. Investing allows your money to outpace inflation and increase in value. Investing is often described as putting your money to work because the invested capital is used to generate a return over time.

Here are some reasons you can consider starting investing:

- Meeting Financial Goals – Imagine you need 100,000 in 10 years. You can calculate the monthly investment required to reach a goal of $100,000 in 10 years, assuming 8-10% annual rate of return, you need to invest around $550 each month if compounded annually.

Investing can help you stay disciplined and on track to meet your financial goals. - Inflation Protection – Inflation decreases the value of money over time by reducing its purchasing power. This decrease in purchasing power means that if you hold cash or other assets that do not keep pace with inflation, you will be able to buy fewer goods and services in the future than you could today. The US inflation rate is around 7% in 2022, while the interest rate offered by commercial banks on deposits is around 1%.

Can you imagine, your money in the bank accounts losing its value by 6% every year? - Long-Term Wealth Creation – The story of Ronald Reid, a Janitor who amassed an $8 million fortune through savvy investments, is a classic example of long-term wealth creation. When Reid passed away in 2014 at the age of 92, his estate was valued at approximately $8 million. Just google his name you will find many inspiring articles.

- Potential for Passive Income: Certain types of investments, such as dividend-paying stocks, can provide a source of passive income that can help supplement your regular income. For example- P&G has been paying a dividend for 132 consecutive years since its incorporation in 1890 and has increased its dividend for 66 consecutive years.

- Tax and Retirement Benefits: Many retirement accounts, such as 401(k)s and traditional IRAs (USA), offer tax-deferred growth, which means that you won’t pay taxes on the earnings until you withdraw the money till retirement. Your money can keep growing for years without paying taxes on gains.

Some investments, such as municipal bonds, also offer tax-free income. - Provide safety & Peace: No one knows the future, but investing a regular amount of money can also provide a safety net for you and your family in case of emergencies like losing a job. By investing regularly, you can build up a nest egg that can help you cover your expenses if you’re faced with unexpected financial challenges, which will provide you peace of mind.

Why Invest Right Now?

George’s Dilemma: I understood the importance of investing. But why should I start right now? I am young I should live my life to the fullest. I will invest later in my life when I settle down. I have plenty of time to reach my financial goals.

Are you in the same dilemma?

The length of time you invest can significantly impact your returns. Here are a few case studies on why you should start investing now, regardless of your age and money:

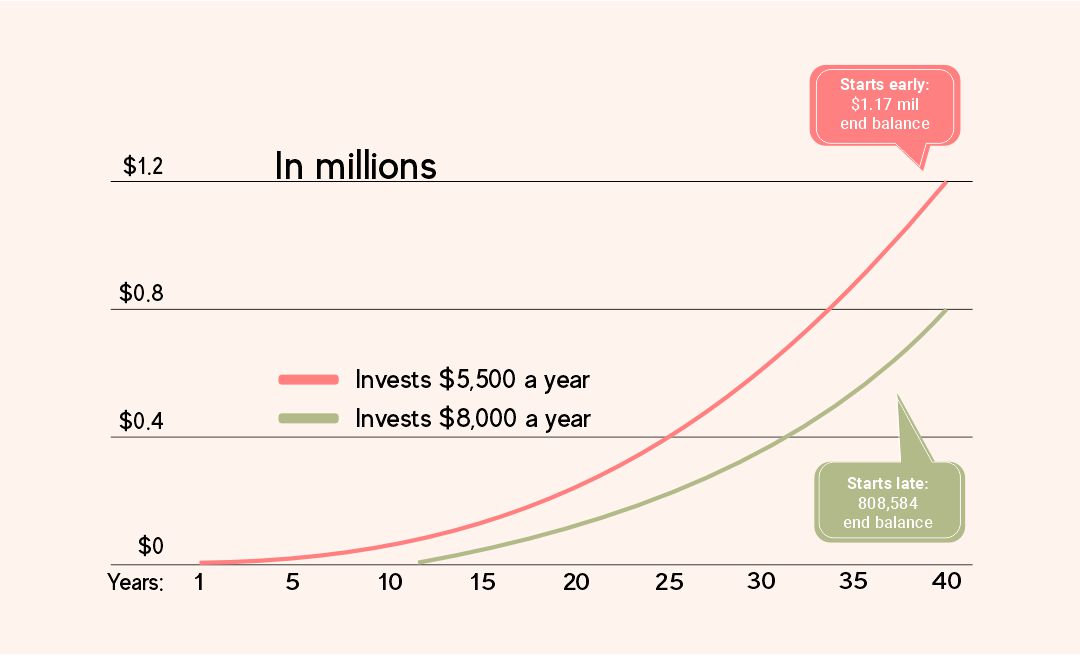

Case Study 1-Early Vs. Late Investing

Tortoise and Hare decided to invest. Suppose, Tortoise invested $5,500 per year for 40 years, while Hare started 10 years later and invested $8,000 per year for 30 years. Assuming both earned a 7% annual return, here’s what their investment portfolios would look like after 40 years:

As you can see, even though Hare started with a larger initial investment, Tortoise’s consistent investing over a longer period of time resulted in a higher final portfolio value due to the power of compounding.

Takeaway

it’s never too early to start investing, even if the initial amount is small.

Case Study 2- Power Of Compounding

Compounding allows your money to grow exponentially, as you earn returns not only on your initial investment but also on the returns that investment generates ( interest on interest).

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”

–Albert Einstein

Let us take the example – George started investing at age of 18, he put $100 every month in S&P 500.

The average rate of return he got was 10% p.a., and he continuously invested from 18 to 65 years of age.

Let us see how much returns he could make by consistently investing for 47 years.

Credits – https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

This means if you invest $100 per month for 47 years at a 10% annual interest rate in S&P 500, you would have a total of $1,281,919.73 at the end of the investment period.

Seems unbelievable! This is the power of compound interest – even small, regular investments can make you a Millionaire.

Takeaway

Start early. The power of compounding takes time to work its magic.

Case Study 3- Save vs. Invest

Assuming an annual return of 1% for a savings account in a regular bank and 10% for a stock market S&P investment, here’s how $10,000 invested for 10 years would compare:

- Savings Account: If you save the $10,000 in a savings account at 1% annual interest rate, the money will grow to approximately $12,194.21 after 20 years.

- S&P investment: If you invest $10,000 in the stock market and earn a 10% annual return, the money would grow to approximately $67,275.52 after 20 years.

Calculate With Rule of 72

The Rule of 72 can be a useful tool for estimating the number of years it takes for your money to double based on the annual rate of return.

To calculate the number of years it takes to double your money,

Formula = 72

Return % Per Annum.

The number of years taken by a Savings Account to double

= 72/1

72 years

The number of years taken by a 10% return investment to double

= 72/10

7.2 Years

The above calculation is only considering fix returns, but usually our investment grows with compounded returns.

Takeaway

For comparing investments, calculate how long it takes to double your money.