Asset Vs. Liability?

“Asset is something that puts money in your pocket. A liability takes money out of your pocket.”

— Robert Kiyosaki

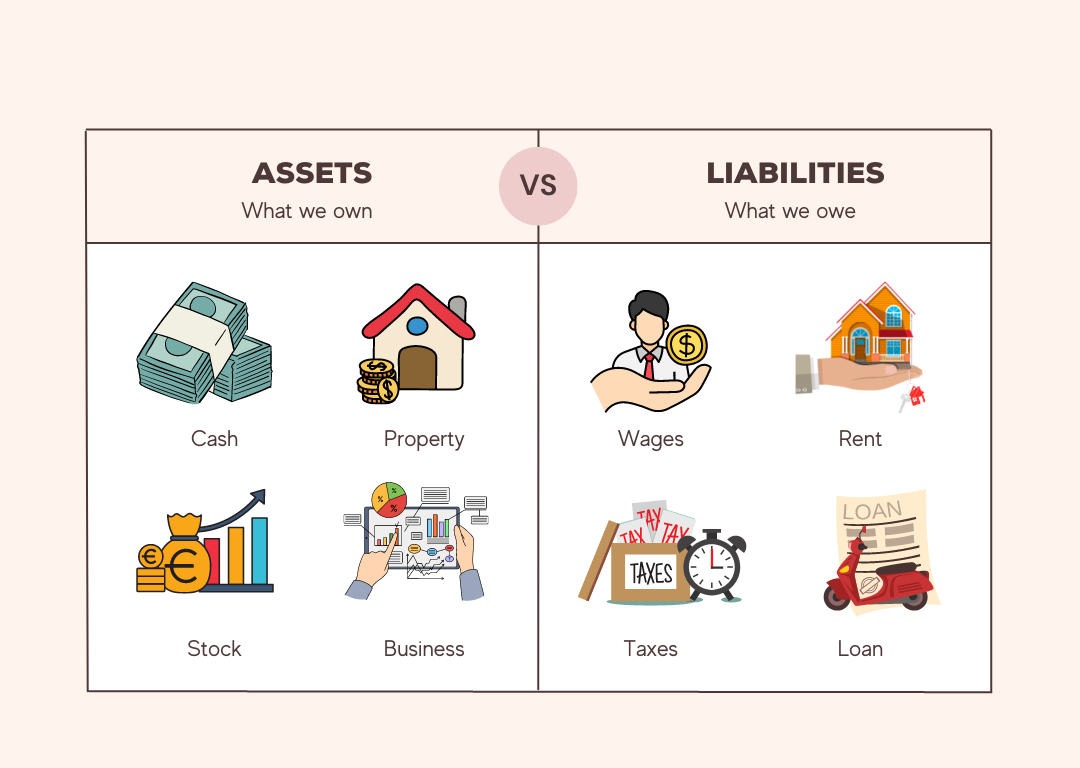

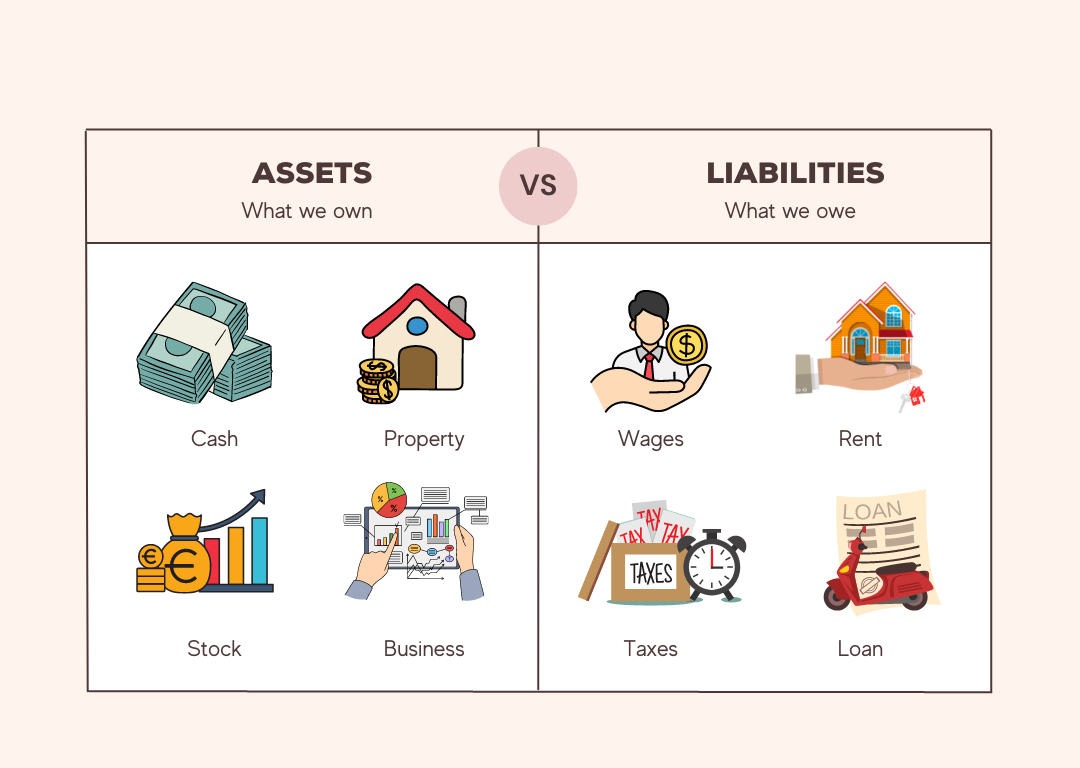

Understanding the concepts of assets and liabilities is a critical part of personal finance and investment planning. It can help individuals make educated decisions.

What is an Asset?

An asset is any useful thing that holds a value that can be converted into cash equivalent.

Example

Imagine when George turned 35, he purchased a house to rent. George’s initial investment was $100,000, which served as the down payment on the $500,000 purchase price. He obtained a mortgage loan for the remaining $400,000, on which he would be charged interest at 5% per year.

His monthly payment and other expenses are around $3000. He can rent it for 3500/month.

In this case, his house is an asset. The house is putting $500/month in his pocket as positive cashflow and the value of house is also growing over time.

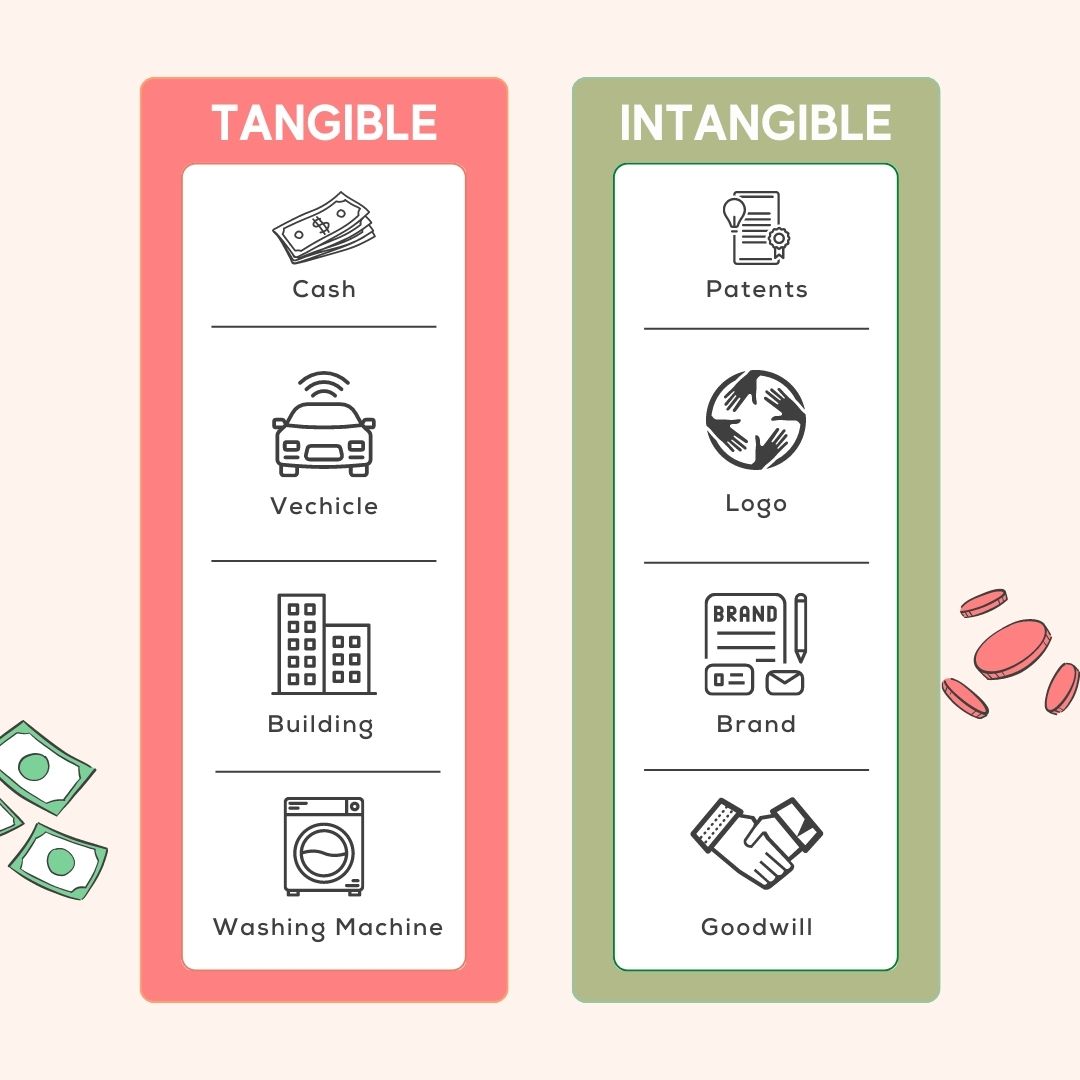

Assets are generally classified into two categories: tangible and intangible.

Tangible assets are physical objects that have value, such as real estate, precious metals, and collectibles. Examples of tangible assets include

- Real estate properties (e.g., homes, commercial buildings)

- Commodities (e.g., gold, silver, oil)

- Art, antiques, and collectibles

- Vehicles and machinery.

Intangible assets are non-physical assets with value, such as patents, trademarks, and copyrights.

Examples of intangible assets include:

- Intellectual property (e.g., patents, trademarks, copyrights),

- Company brands and logos

- Software and technology

- Customer lists, and business relationships.

What is Liability?

Obligations and debts we owe are a liability.

It is usually a monetary burden on an individual or a company who has to repay either a lumpsum at a point in time or in installments over a period of time.

Example

Let’s say George purchased a boat for $100,000. He took a loan and paid $2000 as a monthly payment. Maintenance and miscellaneous add up to $500/month. The boat’s value decreased over time due to depreciation. He sold the boat at $50000 after 2 years.

In this case, the boat loan and the ongoing maintenance expenses created a financial obligation or debt for George, making the boat a liability. When George sold the boat, he could only recoup a portion of what he had initially paid for it, resulting in a loss.

Examples of liabilities include:

- Mortgages

- Car loans

- Student loans

- Credit card debt

- Personal loans

- Medical bills

- Business loans

- Tax liabilities

Can liability be an asset?

It all depends on the cash flow it is generating.

As Robert Kiyosaki said, Asset puts money in your pocket.

While liabilities are typically viewed as financial obligations that need to be paid off, there are certain situations where liability can be considered an asset. One example is when a company takes on debt to fund its growth.

The key factor here is whether the company can use the debt to generate a positive cash flow, meaning that the returns from the investment exceed the debt costs, including interest payments. If the company can generate more cash from its assets than it owes in liabilities, then the debt can be seen as an asset that is helping the company grow and increase its value.

Takeaway

Wealthy: Accumulate Assets

Poor: Spend on Liabilities

“Asset is something that puts money in your pocket. A liability takes money out of your pocket.”

— Robert Kiyosaki

Understanding the concepts of assets and liabilities is a critical part of personal finance and investment planning. It can help individuals make educated decisions.

What is an Asset?

An asset is any useful thing that holds a value that can be converted into cash equivalent.

Example

Imagine when George turned 35, he purchased a house to rent. George’s initial investment was $100,000, which served as the down payment on the $500,000 purchase price. He obtained a mortgage loan for the remaining $400,000, on which he would be charged interest at 5% per year.

His monthly payment and other expenses are around $3000. He can rent it for 3500/month.

In this case, his house is an asset. The house is putting $500/month in his pocket as positive cashflow and the value of house is also growing over time.

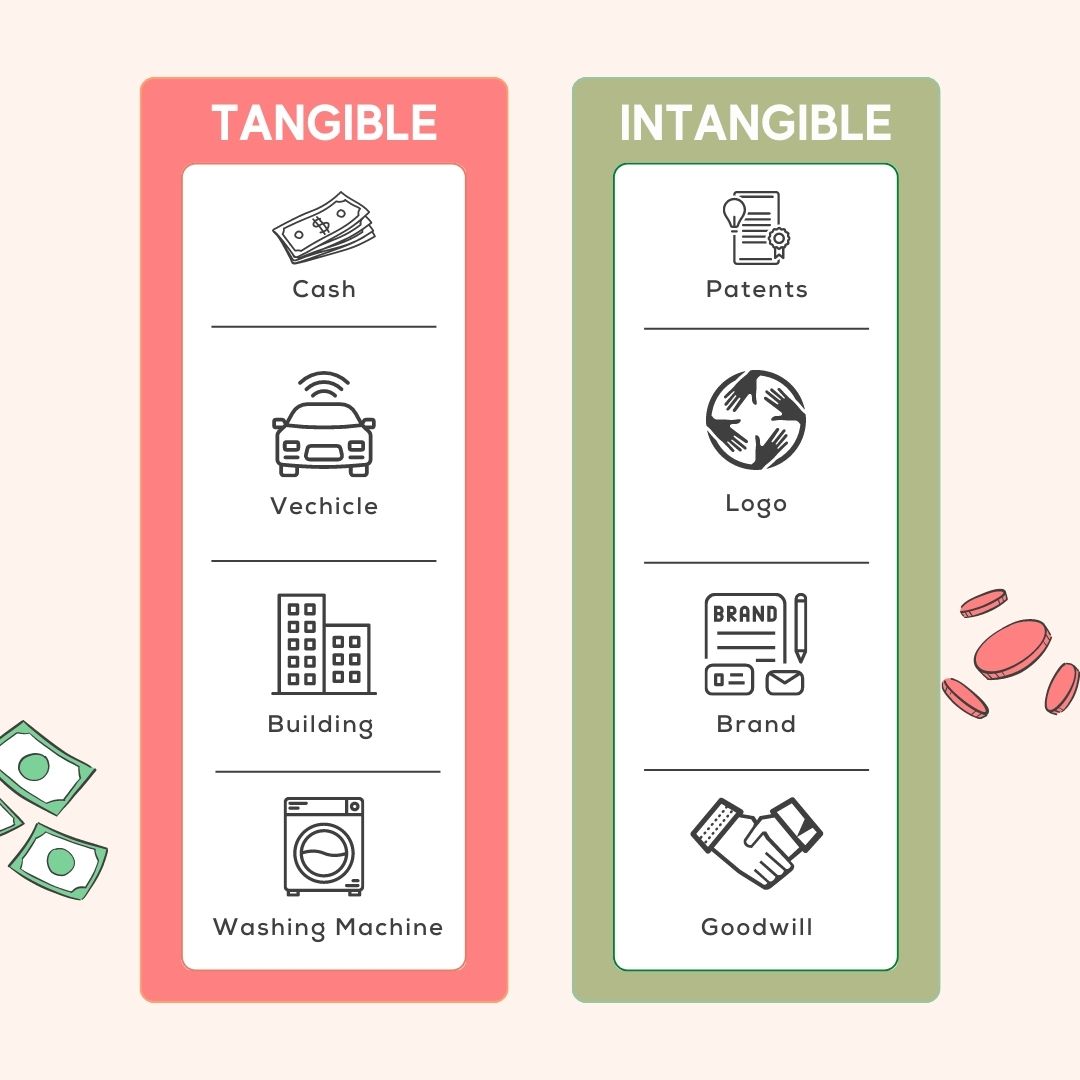

Assets are generally classified into two categories: tangible and intangible.

Tangible assets are physical objects that have value, such as real estate, precious metals, and collectibles. Examples of tangible assets include

- Real estate properties (e.g., homes, commercial buildings)

- Commodities (e.g., gold, silver, oil)

- Art, antiques, and collectibles

- Vehicles and machinery.

Intangible assets are non-physical assets with value, such as patents, trademarks, and copyrights.

Examples of intangible assets include:

- Intellectual property (e.g., patents, trademarks, copyrights),

- Company brands and logos

- Software and technology

- Customer lists, and business relationships.

What is Liability?

Obligations and debts we owe are a liability.

It is usually a monetary burden on an individual or a company who has to repay either a lumpsum at a point in time or in installments over a period of time.

Example

Let’s say George purchased a boat for $100,000. He took a loan and paid $2000 as a monthly payment. Maintenance and miscellaneous add up to $500/month. The boat’s value decreased over time due to depreciation. He sold the boat at $50000 after 2 years.

In this case, the boat loan and the ongoing maintenance expenses created a financial obligation or debt for George, making the boat a liability. When George sold the boat, he could only recoup a portion of what he had initially paid for it, resulting in a loss.

Examples of liabilities include:

- Mortgages

- Car loans

- Student loans

- Credit card debt

- Personal loans

- Medical bills

- Business loans

- Tax liabilities

Can liability be an asset?

It all depends on the cash flow it is generating.

As Robert Kiyosaki said, Asset puts money in your pocket.

While liabilities are typically viewed as financial obligations that need to be paid off, there are certain situations where liability can be considered an asset. One example is when a company takes on debt to fund its growth.

The key factor here is whether the company can use the debt to generate a positive cash flow, meaning that the returns from the investment exceed the debt costs, including interest payments. If the company can generate more cash from its assets than it owes in liabilities, then the debt can be seen as an asset that is helping the company grow and increase its value.

Takeaway

Wealthy: Accumulate Assets

Poor: Spend on Liabilities