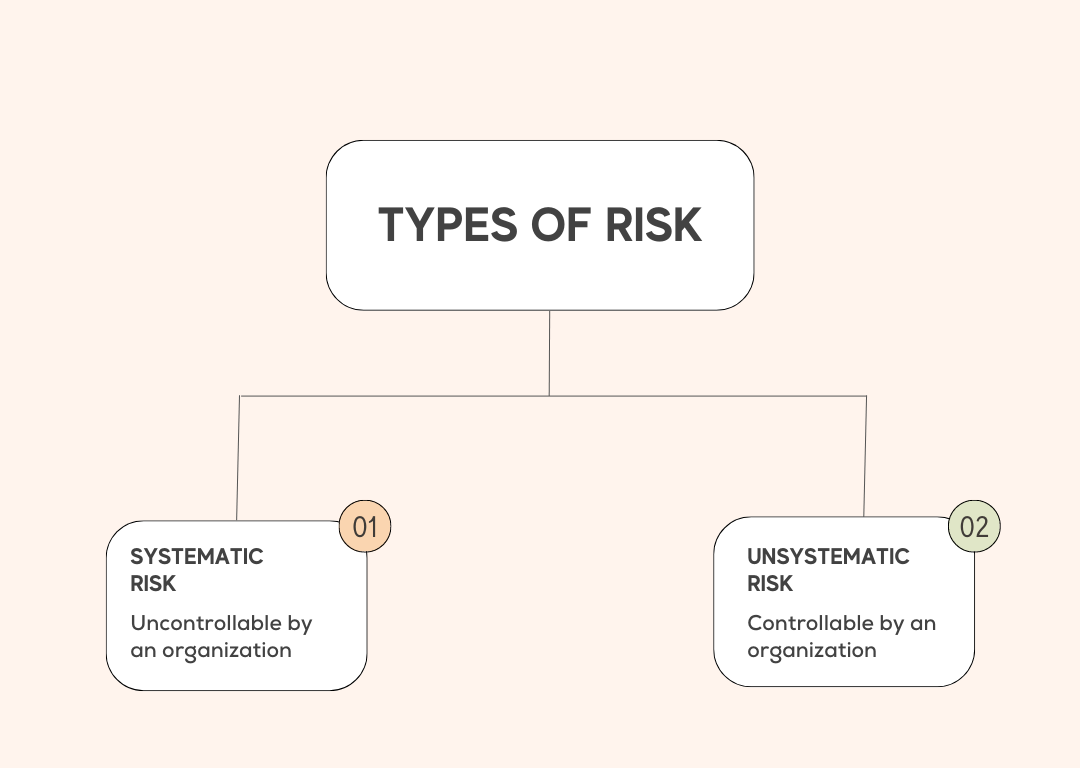

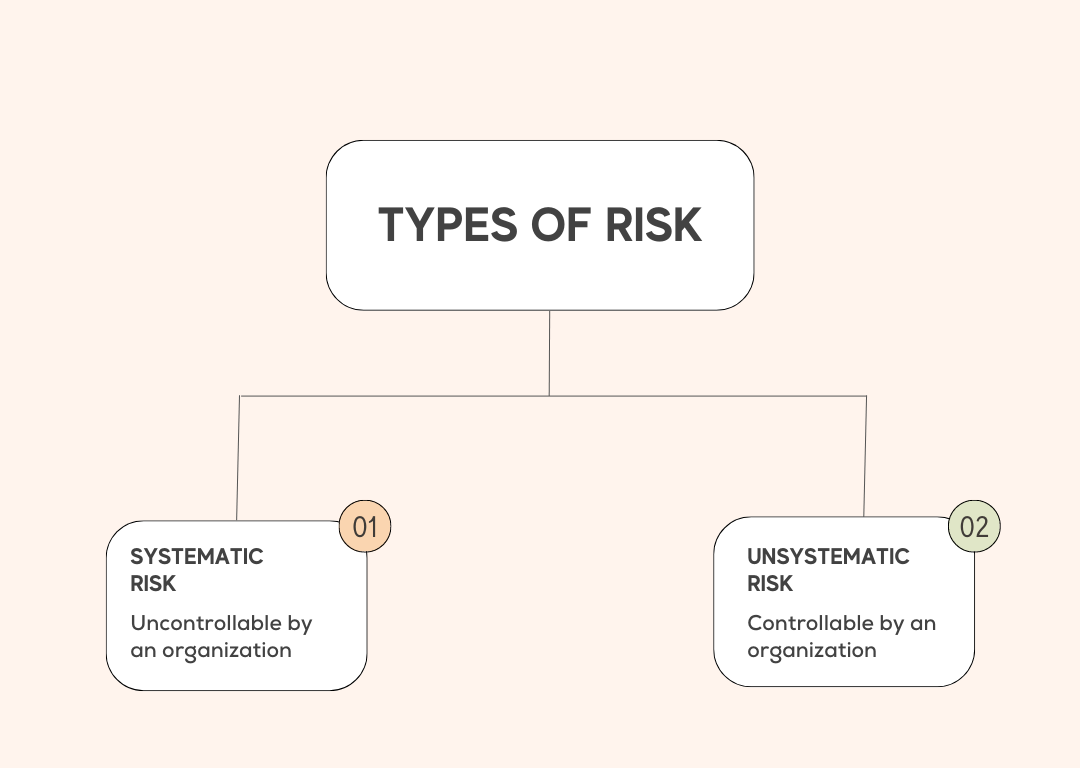

Types of Risks

No company works in isolation. Every company has an obligation to:

- Deliver products/services

- Pay taxes to the government

- Distribute returns to shareholders

- Pay salaries to employees

However, during this process, the company may face challenges and risks.

Unsystematic Risk

Unsystematic risk refers to risks specific to a particular company or industry rather than the entire market.

Example

Suppose George’s burger joint faces competition from a new entrant in the market. After a year of operation, a burger shop named Jim’s Burger Joint opened right across from George’s store. As a consequence, the customer base gets divided, causing a reduction in demand for George’s products.

Unsystematic risk, also known as diversifiable or specific risk.

Types of Unsystematic Risk

- Financial Risk: The company has massive debt and can not meet its financial obligations.

- Business Risk: Risk is associated with a particular company, such as poor management, labor strikes, etc.

- Industry-Specific Risk: This type of risk is related to a particular industry, such as changes in market demand, technological advancements, or new entrants in the market. For example, Netflix and streaming services pose a risk for movie theaters.

- Regulatory Risk: Changes in laws, regulations, and policies can affect a company’s financial performance. For example- an additional tax on luxury items or expensive cars can impact sales.

- Operational Risk: This refers to the risk associated with the day-to-day operations of a company, such as supply chain disruptions, technology failures, or human errors.

- Competition Risk: Increased competition can lead to lower prices, reduced market share, and decreased profitability.

Systematic Risk

Systematic risk refers to the type of risk that is caused by external factors that are beyond the control of a company. It is also known as market risk or non-diversifiable risk and impacts the entire market segment.

Example

Imagine in the year 2050, due to increased global warming, the world decided to ban non-renewable oil products. This decision can pose a risk to the entire oil & gas industry. This type of risk is caused by external factors beyond any specific company’s or individual’s control, affecting all investments in the same sector.

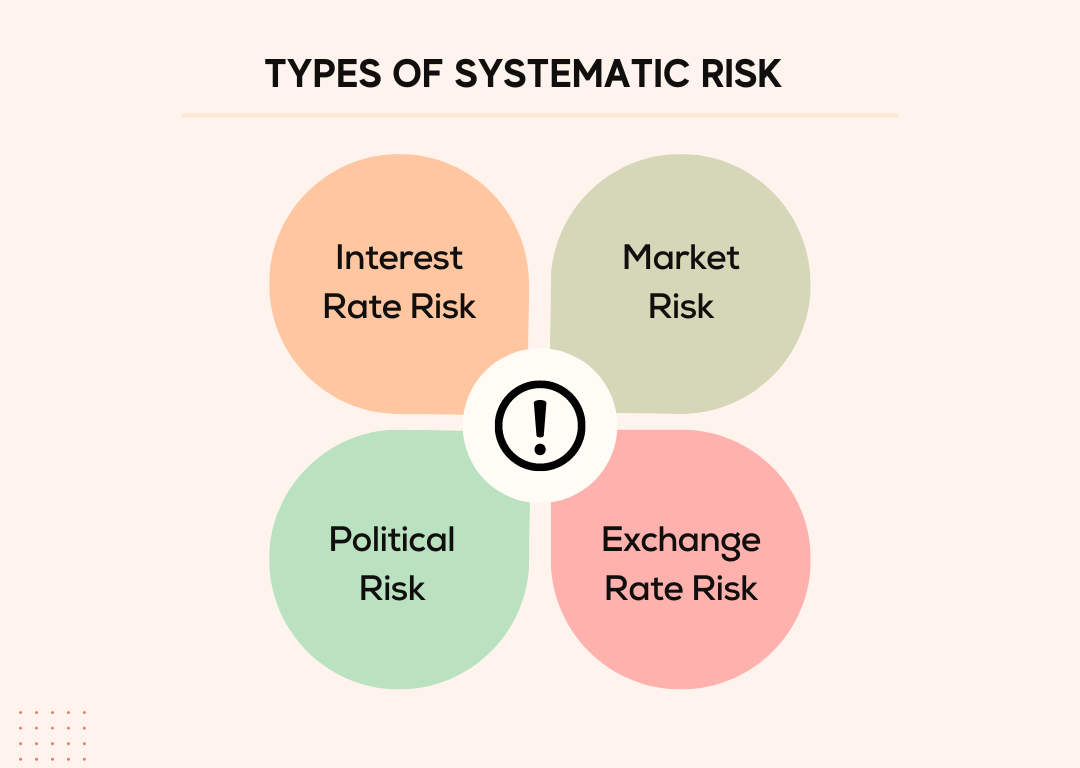

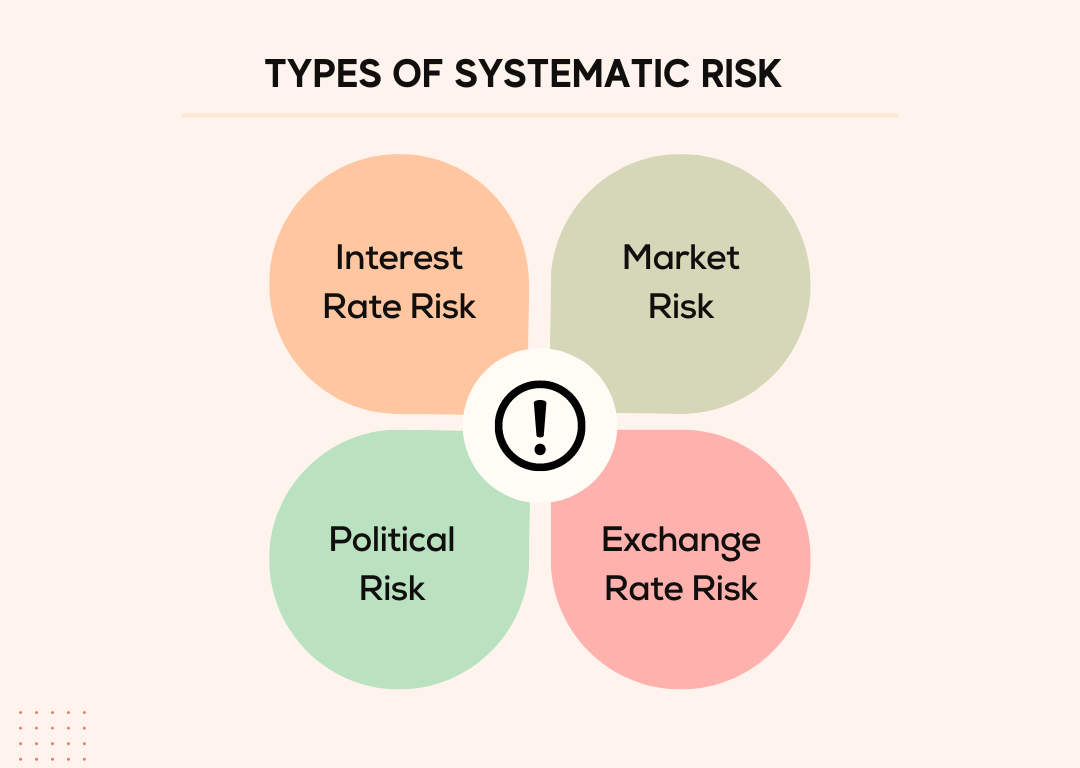

Types of Systematic Risk

Market Risk: Market risk results from investors behaving similarly or following a “herd mentality.” This means that they are influenced by the actions of others and the trend of the market, causing security prices to move in the same direction.

For example, if a few big blue chips are going down and other investors feel negative and follow this trend, even well-performing stocks will experience a decrease in their share prices. Market risk constitutes almost two-thirds of total systematic risk. Therefore, systematic risk is also called market risk.

Interest Rate Risk: Risk due to change in repo rate or interest rates, as it would affect the credit cycles in the market. Mainly, it impacts fixed-income securities since the prices of bonds have an inverse relationship with the interest rate. But the overall impact can be seen on securities also.

Inflation Risk: Risk due to a rise in prices of commodities or a fall in purchasing power of people, which would affect the buying decision of consumers.

Political Risk: Risk due to any government intervention or political mishaps in the country affecting the market.

How to measure risk?

There are several risk-measuring indicators for analyzing the risk associated with the company. Let us discuss a few of them :

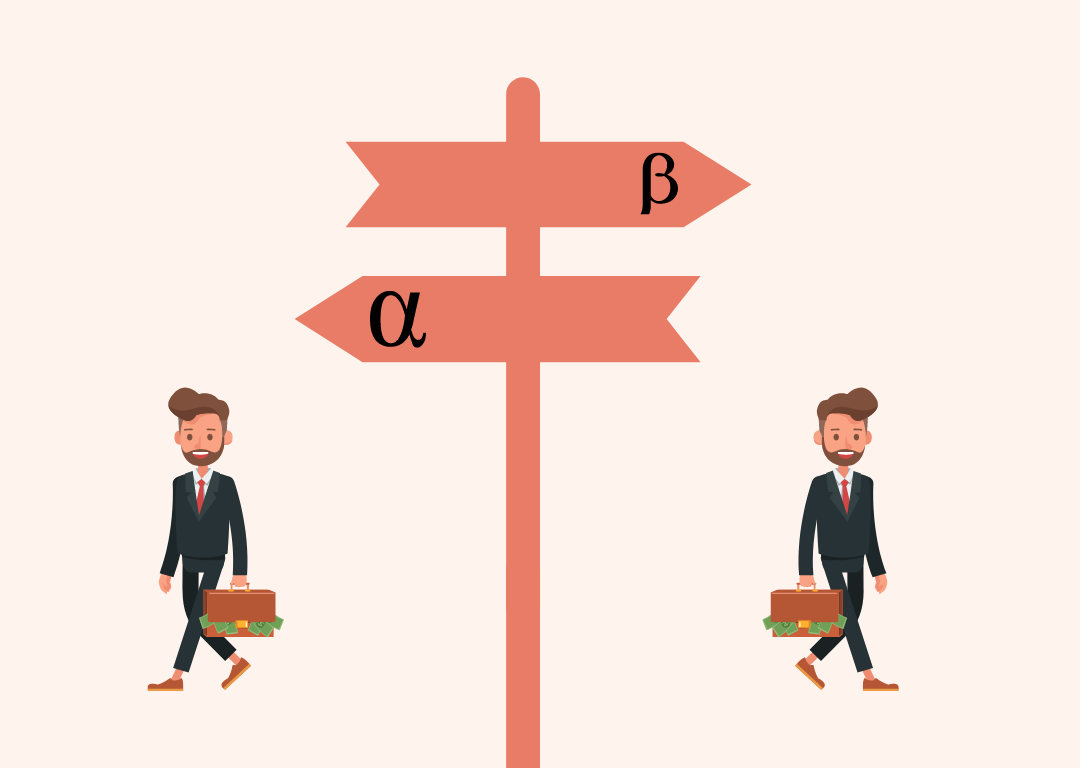

Alpha

Alpha is a measure of the performance of an investment relative to a benchmark, such as a market index or S&P 500. A positive alpha indicates that an investment has performed better than its benchmark, while a negative alpha indicates underperformance.

Example

When George used to make active investments, his goal was to beat the returns of the S&P 500, i.e., he wanted to make more returns than S&P 500 annually.

In 2002, the average return generated by S&P 500 was 10%, whereas his stock portfolio generated an average return of 15%. Thus, he could develop a 5% extra return than the market.

Therefore, Alpha refers to the excess return that your investment gives compared to a benchmark index. Here, the benchmark George was S&P 500.

So, the Alpha generated by George’s portfolio was +5% (+sign indicates positive returns). This shows the outperformance of George’s portfolio.

If George’s portfolio generated 8%, the Alpha would have -2%. This shows underperformance by George’s portfolio.

Key Takeaways

If your investments are not performing better than the S&P 500 index, you can consider investing in the benchmark. 90% of individuals and mutual fund managers can not beat S&P 500 over a long period of time.

Beta

Beta measures how volatile that investment is compared to the overall market index or any other benchmark.

Usually, when a stock is high in demand, its price fluctuates more than the low-demand stock. Stocks with higher beta could be riskier.

In the USA, the volatility of stocks is primarily compared against the S&P benchmark. The Beta of this index is 1.

- If a stock’s beta is less than 1, it is considered low volatile.

- If a stock’s beta is more than 1, it is considered a highly volatile stock.

- If the beta of a stock is 1, it means there is no volatility in the stock.

For example, Apple Inc. has a beta of 1.27. This means the stock is 27% more volatile than S&P 500 index.

Key Takeaways

Alpha and Beta help investors measure unsystematic risk.

However, there are no specific tools or techniques to measure systematic risk because it is generalized to the entire market and economy and not restricted to a particular company or sector.

No company works in isolation. Every company has an obligation to:

- Deliver products/services

- Pay taxes to the government

- Distribute returns to shareholders

- Pay salaries to employees

However, during this process, the company may face challenges and risks.

Unsystematic Risk

Unsystematic risk refers to risks specific to a particular company or industry rather than the entire market.

Example

Suppose George’s burger joint faces competition from a new entrant in the market. After a year of operation, a burger shop named Jim’s Burger Joint opened right across from George’s store. As a consequence, the customer base gets divided, causing a reduction in demand for George’s products.

Unsystematic risk, also known as diversifiable or specific risk.

Types of Unsystematic Risk

- Financial Risk: The company has massive debt and can not meet its financial obligations.

- Business Risk: Risk is associated with a particular company, such as poor management, labor strikes, etc.

- Industry-Specific Risk: This type of risk is related to a particular industry, such as changes in market demand, technological advancements, or new entrants in the market. For example, Netflix and streaming services pose a risk for movie theaters.

- Regulatory Risk: Changes in laws, regulations, and policies can affect a company’s financial performance. For example- an additional tax on luxury items or expensive cars can impact sales.

- Operational Risk: This refers to the risk associated with the day-to-day operations of a company, such as supply chain disruptions, technology failures, or human errors.

- Competition Risk: Increased competition can lead to lower prices, reduced market share, and decreased profitability.

Systematic Risk

Systematic risk refers to the type of risk that is caused by external factors that are beyond the control of a company. It is also known as market risk or non-diversifiable risk and impacts the entire market segment.

Example

Imagine in the year 2050, due to increased global warming, the world decided to ban non-renewable oil products. This decision can pose a risk to the entire oil & gas industry. This type of risk is caused by external factors beyond any specific company’s or individual’s control, affecting all investments in the same sector.

Types of Systematic Risk

Market Risk: Market risk results from investors behaving similarly or following a “herd mentality.” This means that they are influenced by the actions of others and the trend of the market, causing security prices to move in the same direction.

For example, if a few big blue chips are going down and other investors feel negative and follow this trend, even well-performing stocks will experience a decrease in their share prices. Market risk constitutes almost two-thirds of total systematic risk. Therefore, systematic risk is also called market risk.

Interest Rate Risk: Risk due to change in repo rate or interest rates, as it would affect the credit cycles in the market. Mainly, it impacts fixed-income securities since the prices of bonds have an inverse relationship with the interest rate. But the overall impact can be seen on securities also.

Inflation Risk: Risk due to a rise in prices of commodities or a fall in purchasing power of people, which would affect the buying decision of consumers.

Political Risk: Risk due to any government intervention or political mishaps in the country affecting the market.

How to measure risk?

There are several risk-measuring indicators for analyzing the risk associated with the company. Let us discuss a few of them :

Alpha

Alpha is a measure of the performance of an investment relative to a benchmark, such as a market index or S&P 500. A positive alpha indicates that an investment has performed better than its benchmark, while a negative alpha indicates underperformance.

Example

When George used to make active investments, his goal was to beat the returns of the S&P 500, i.e., he wanted to make more returns than S&P 500 annually.

In 2002, the average return generated by S&P 500 was 10%, whereas his stock portfolio generated an average return of 15%. Thus, he could develop a 5% extra return than the market.

Therefore, Alpha refers to the excess return that your investment gives compared to a benchmark index. Here, the benchmark George was S&P 500.

So, the Alpha generated by George’s portfolio was +5% (+sign indicates positive returns). This shows the outperformance of George’s portfolio.

If George’s portfolio generated 8%, the Alpha would have -2%. This shows underperformance by George’s portfolio.

Key Takeaways

If your investments are not performing better than the S&P 500 index, you can consider investing in the benchmark. 90% of individuals and mutual fund managers can not beat S&P 500 over a long period of time.

Beta

Beta measures how volatile that investment is compared to the overall market index or any other benchmark.

Usually, when a stock is high in demand, its price fluctuates more than the low-demand stock. Stocks with higher beta could be riskier.

In the USA, the volatility of stocks is primarily compared against the S&P benchmark. The Beta of this index is 1.

- If a stock’s beta is less than 1, it is considered low volatile.

- If a stock’s beta is more than 1, it is considered a highly volatile stock.

- If the beta of a stock is 1, it means there is no volatility in the stock.

For example, Apple Inc. has a beta of 1.27. This means the stock is 27% more volatile than S&P 500 index.

Key Takeaways

Alpha and Beta help investors measure unsystematic risk.

However, there are no specific tools or techniques to measure systematic risk because it is generalized to the entire market and economy and not restricted to a particular company or sector.