Determine the value of a company.

The value of a business or company is based on the returns it will generate in the future.

Are the stock price and value of a company the same?

In the short term, the value of a company is not based on the stock price it is trading. The stock price is simply what investors are willing to pay for a share of the company’s stock at a given moment. The value of a company is a more comprehensive and fundamental measure of the worth of the company’s assets, earnings, and future growth potential.

The two most important things that determine the value of a company are

1) Growth– How much profits are going to grow

The value of a business can also be based on various factors such as its revenue, earnings, growth potential, and future market conditions.

2) Sustainability of profit- How long that profit level is sustainable.

The value of a company is also affected by the level of competition and the overall state of the economy.

Characteristics of Good Business

Have you wondered why some companies succeed and others fail over time?

How can we identify the winners from the losers for investment purposes?

Think of the ROE as the amount a business gives back to you each year as a shareholder.

Here are some characteristics of a good business:

- Strong Financials: A good company should have consistent and reliable revenue streams, a sound balance sheet, and manageable debt levels.

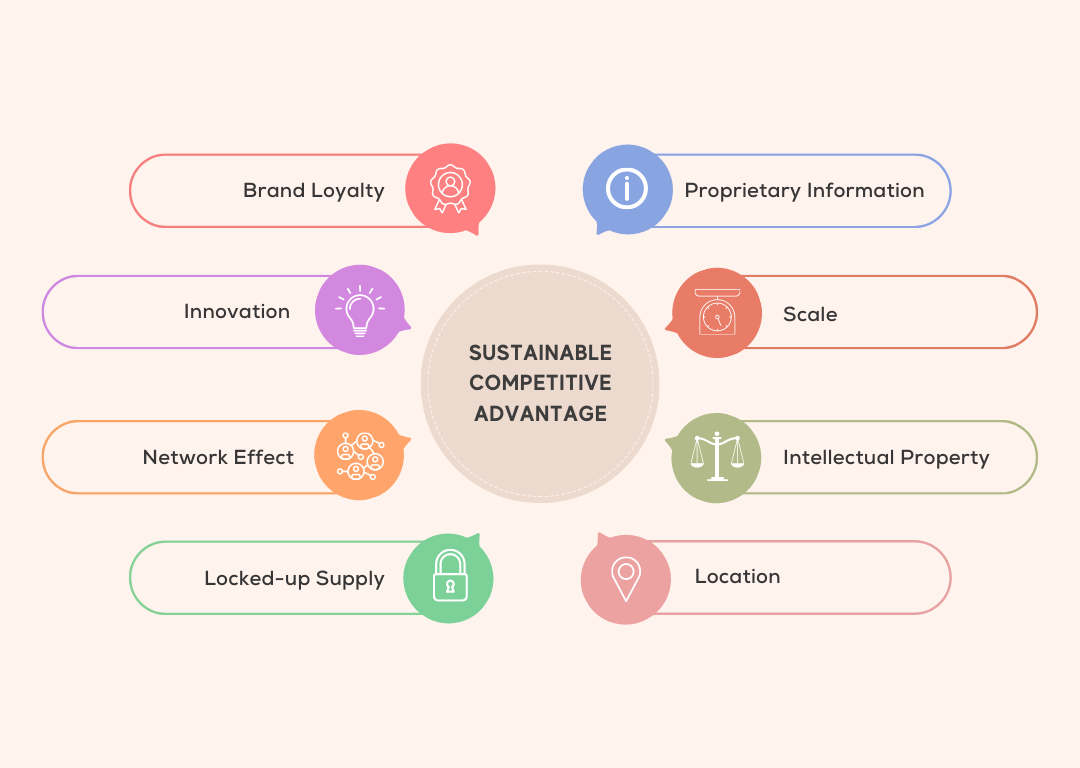

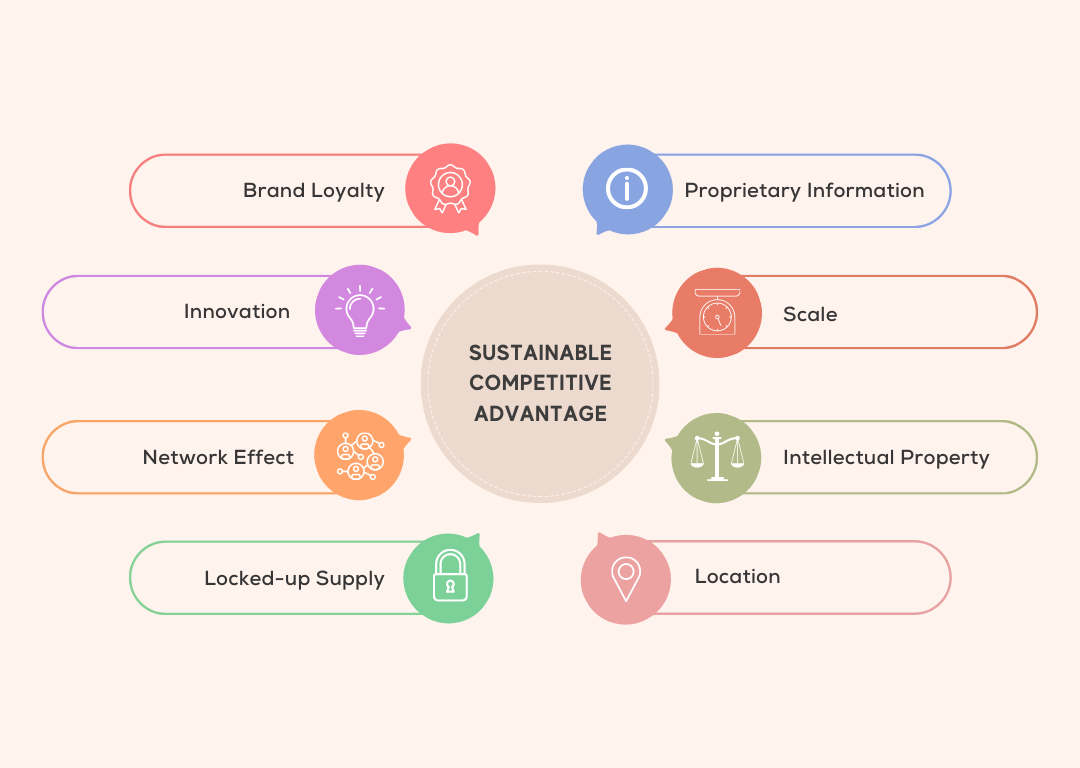

- Competitive Advantage: The business should have a unique selling proposition that differentiates it from its competitors. This could be a strong brand, proprietary technology, high switching costs, network effects( ex, distribution advantage), or a Low-Cost(ex-bulk order).

- Scalability: The business should have the ability to grow and expand its operations, either by increasing its customer base or through the introduction of new products and services.

- Sustainability: The business should operate in a market with strong and growing demand for its products or services in the future. Some companies, like big oil companies, might not exist tomorrow due to changes in user behavior.

- Experienced Management: A good business should have a management team with a proven track record of success and the ability to make sound decisions for the company.

- Understand what the company does: Think of companies you spend your money on daily or the products you use. For example – Netflix, Microsoft, Apple, and kraft.

Key takeaways

When investing in stocks, think of it as buying a business. Imagine you’re investing in a local Burger Store. Can you think of what questions you will ask?

- How many assets does this business own?

- How much debt does this business have?

- What is quoted actual value of the business? Is the selling price undervalued or overvalued?

- How much profit does this store make each year?

- What is the expected future value of revenue?

To find the answers, you need to look at the financial statements covered later in the next module.

The value of a business or company is based on the returns it will generate in the future.

Are the stock price and value of a company the same?

In the short term, the value of a company is not based on the stock price it is trading. The stock price is simply what investors are willing to pay for a share of the company’s stock at a given moment. The value of a company is a more comprehensive and fundamental measure of the worth of the company’s assets, earnings, and future growth potential.

The two most important things that determine the value of a company are

1) Growth– How much profits are going to grow

The value of a business can also be based on various factors such as its revenue, earnings, growth potential, and future market conditions.

2) Sustainability of profit- How long that profit level is sustainable.

The value of a company is also affected by the level of competition and the overall state of the economy.

Characteristics of Good Business

Have you wondered why some companies succeed and others fail over time?

How can we identify the winners from the losers for investment purposes?

Think of the ROE as the amount a business gives back to you each year as a shareholder.

Here are some characteristics of a good business:

- Strong Financials: A good company should have consistent and reliable revenue streams, a sound balance sheet, and manageable debt levels.

- Competitive Advantage: The business should have a unique selling proposition that differentiates it from its competitors. This could be a strong brand, proprietary technology, high switching costs, network effects( ex, distribution advantage), or a Low-Cost(ex-bulk order).

- Scalability: The business should have the ability to grow and expand its operations, either by increasing its customer base or through the introduction of new products and services.

- Sustainability: The business should operate in a market with strong and growing demand for its products or services in the future. Some companies, like big oil companies, might not exist tomorrow due to changes in user behavior.

- Experienced Management: A good business should have a management team with a proven track record of success and the ability to make sound decisions for the company.

- Understand what the company does: Think of companies you spend your money on daily or the products you use. For example – Netflix, Microsoft, Apple, and kraft.

Key takeaways

When investing in stocks, think of it as buying a business. Imagine you’re investing in a local Burger Store. Can you think of what questions you will ask?

- How many assets does this business own?

- How much debt does this business have?

- What is quoted actual value of the business? Is the selling price undervalued or overvalued?

- How much profit does this store make each year?

- What is the expected future value of revenue?

To find the answers, you need to look at the financial statements covered later in the next module.