Financial Statements

What are the company’s financial statements?

Financial statements are documents(or records) summarizing a company’s financial activities and positions.

They tell investors about the company’s financial health and give a crisp idea about whether the business is worth investing.

“Financial statements are written records that convey the business activities and the financial performance of an entity.”

— Investopedia

Purpose of financial statements

Financial Statements are used by government, investors, analysts, and other stakeholders to assess the performance of a company.

It’s the company’s financial health status at a specific point in time.

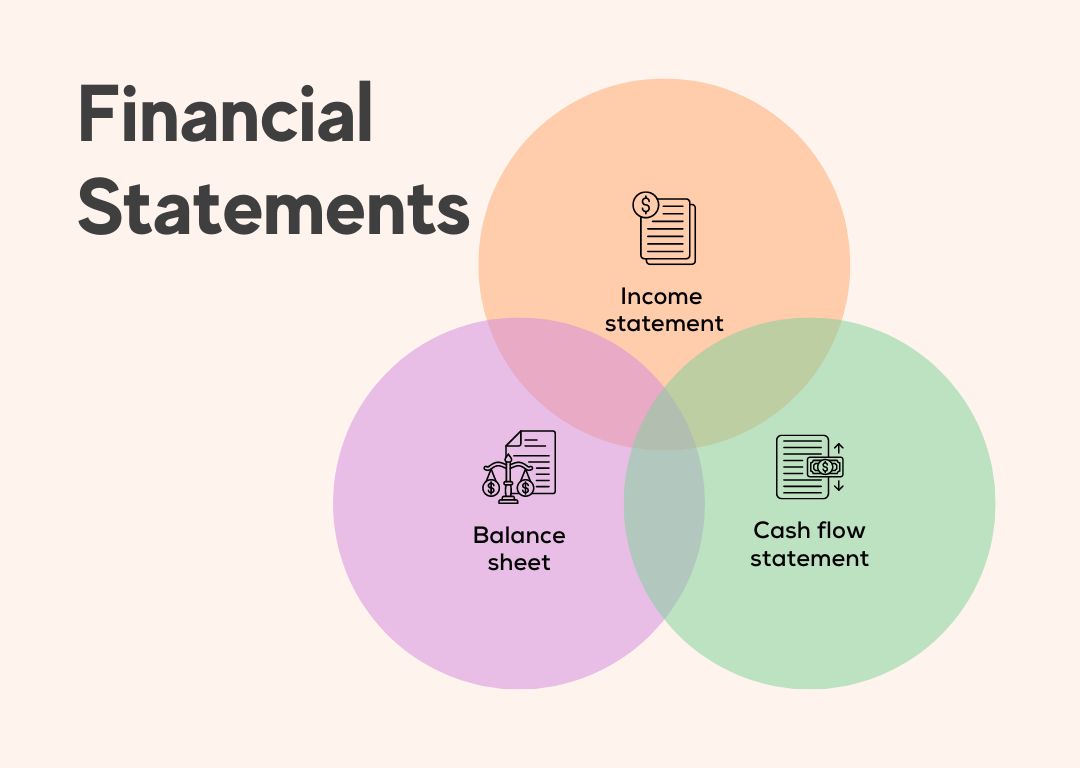

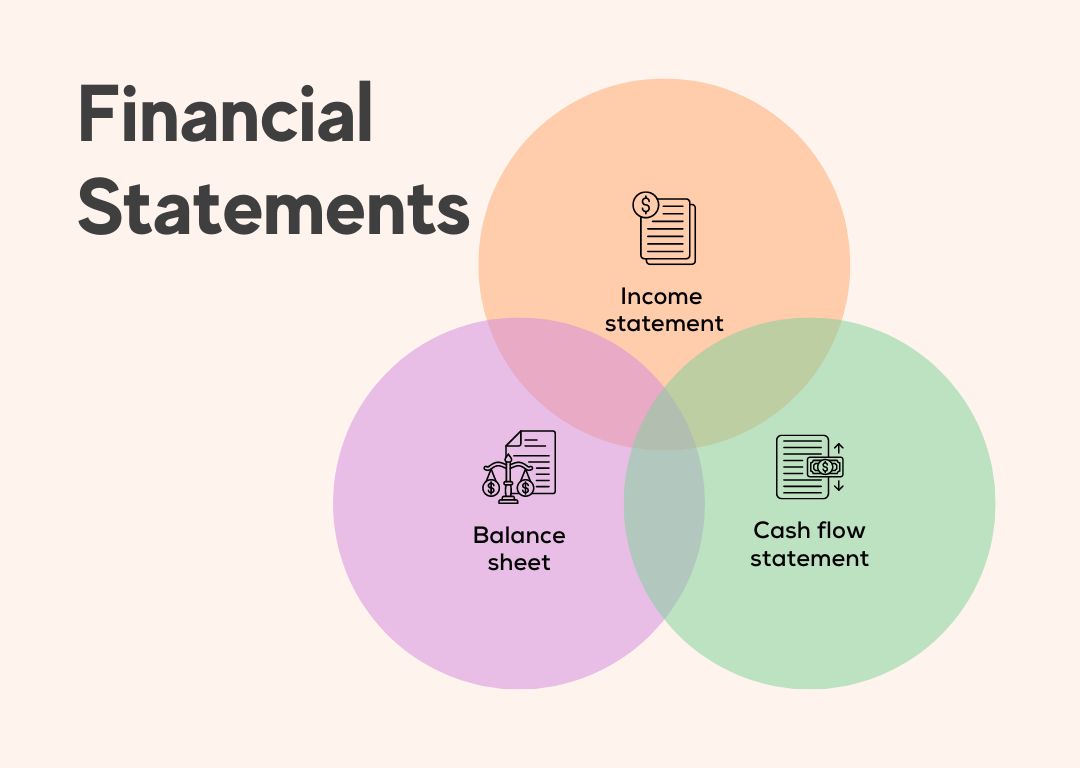

Most common financial statements include

- Income statement – It tells about the company’s revenue, expenses, and profitability over a specific period.

- Balance Sheet – It tells about the assets and liabilities of the company.

- Cash Flow Statement – It tells how much of the actual cash is being generated or spent by the company in a given financial year.

- Retained Earnings Statement– This tells changes in equity and shows the changes in a company’s shareholders’ equity over time.

What is an Income Statement?

An Income Statement is a financial statement that provides a summary of a company’s revenues, expenses, and net income over a specific period of time.

Analogy: It is similar to your personal budget.

An Income Statement typically includes the following information for a particular period of time.

- Revenues: The total amount of money earned by the business from its operations, such as sales revenue.

- Cost of Goods Sold (COGS): The direct costs incurred in producing the products, such as materials, labor, etc.

- Gross Profit: The difference between the company’s revenues and its cost of goods sold.

- Operating Expenses: The indirect costs associated with running the business, such as administrative salaries, rent, utilities, marketing, and other general expenses.

- Net Income: The final profit or loss earned by the company during the period, which is calculated by subtracting all expenses, including taxes, from the company’s total revenues.

An income statement is usually a tabular form of revenue and expenditure of the company which shows net income made or net loss incurred during the year.

Let us go back to George’s Burger Joint.

Income Statement of Burger Joint

For the year ended 2023

Particulars

Amount

Sales Revenue

$190000

COGS

Cost of Raw Materials

$12000

Operating Expenses

Rent & Electricity

Salary of Staffs

Salary of Manager

Equipment

$12000$12000

$24000

$20000

Gross Income

Tax

$110000

$10000

Net Income

$100000

What is a Balance Sheet?

A balance sheet is a financial statement that provides a snapshot of a company’s assets and liabilities at a specific point in time (specific date).

Analogy: It is similar to your net worth.

Let us understand this also with the example of Burger Joint.

Suppose George decided to sell his business. It means he will sell his assets and pay for his liabilities. The balance amount will be his net capital employed (equity) in the company.

Owners’ Equity = Assets – Liabilities

Balance Sheet

Asset

Cash: $100000

Inventory: $20000

Equipments: $20000

Total Assets: $140,000

Liabilities

Account Payable: $40000

George Equity: 100000

Total Equity= 100,000

What is a Cash Flow Statement?

A cash flow statement is a financial statement that shows the inflow and outflow of cash in a business over a specific period of time.

Analogy: It is similar to your checking account statement.

This only includes cash-based transactions. Simply put, it shows how much cash is received versus how much cash is used in different activities throughout the year.

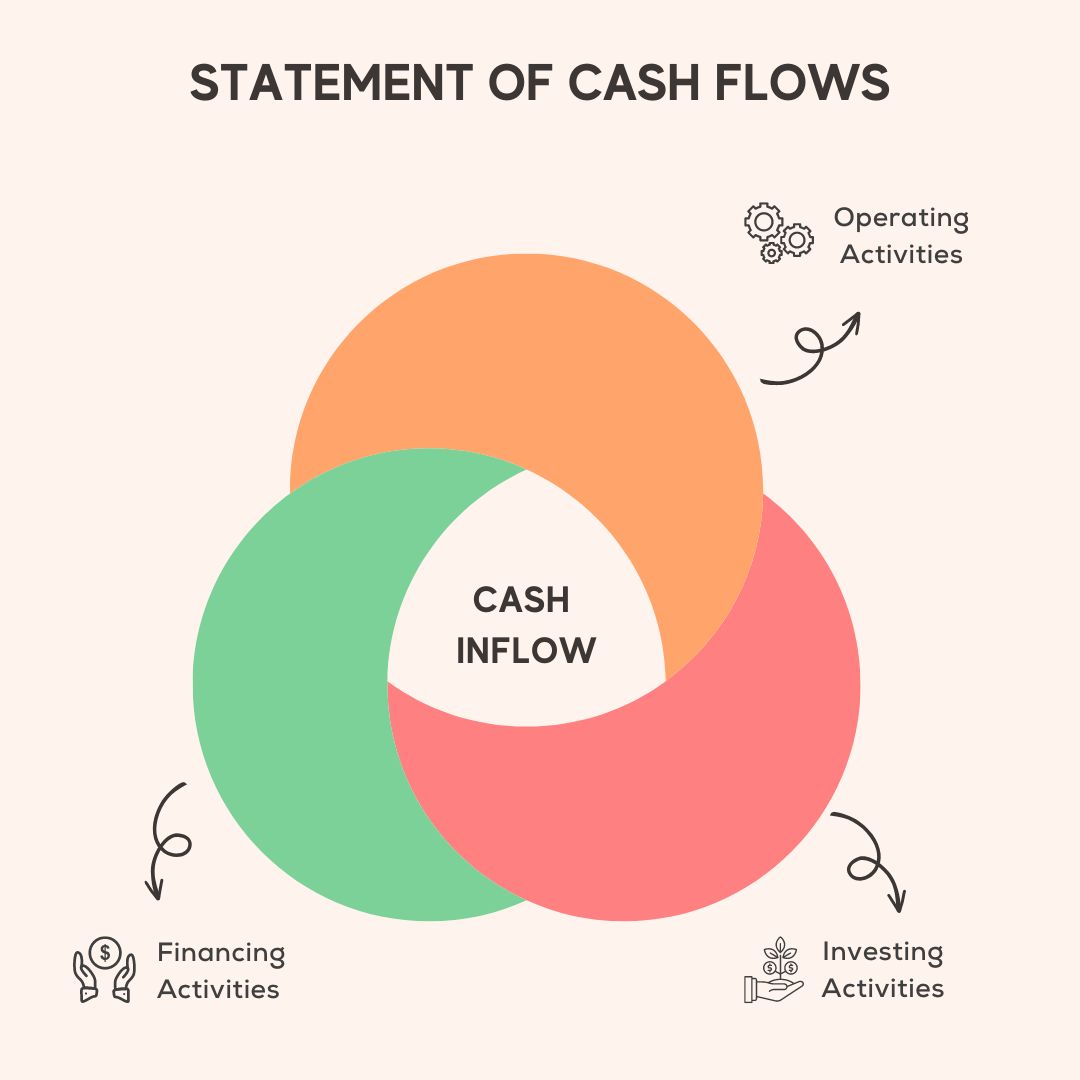

The cash flow statement is divided into three main sections:

1. Operating Activities

This includes cash flows related to the company’s primary operations, such as sales revenue. It also includes changes in working capital, such as accounts receivable, accounts payable, and inventory in a specific period of time(quarter or year).

Positive cash flows indicate that the company’s core business generates cash from its operations.

Negative cash flows indicate the company has trouble generating sufficient cash to fund its operations.

2. Investing Activities

It is cash spent or earned on long-term assets such as property and equipment.

A negative value (cash paid) indicates the company invests in long-term assets like buying property or equipment

A positive value (cash earned) indicates the company is selling long-term assets to generate cash flow.

Example

If a company sold a manufacturing plant for $100,000, it would generate a cash inflow of $100,000 in the investing activities section. While this would increase the company’s annual income, it might not be a good sign for long-term health if it sells its assets to generate cash.

On the other hand, if a company buys assets, it might decrease the cash flow, but it will be added to the assets.

3. Financing Activities

This includes cash flows related to the company’s financing activities, such as the issuance of debt and equity, the payment of dividends, and the repayment of loans in a specific period of time(quarter or year).

Some key takeaways from the financing activities section include

- Changes in debt: This section reports the amount of debt the company has taken on or paid off during the reporting period.

- Changes in equity: The financing activities section also reports changes in the company’s equity, such as the issuance or repurchase of common stock or payment of dividends to shareholders.

- Dividends: If a company pays dividends to its shareholders, this will be reflected in the financing activities section.

Key takeaways

While accounting may not be the most exciting subject for some people, it is an essential skill for anyone who wants to invest their life savings in a company.

What are the company’s financial statements?

Financial statements are documents(or records) summarizing a company’s financial activities and positions.

They tell investors about the company’s financial health and give a crisp idea about whether the business is worth investing.

“Financial statements are written records that convey the business activities and the financial performance of an entity.”

— Investopedia

Purpose of financial statements

Financial Statements are used by government, investors, analysts, and other stakeholders to assess the performance of a company.

It’s the company’s financial health status at a specific point in time.

Most common financial statements include

- Income statement – It tells about the company’s revenue, expenses, and profitability over a specific period.

- Balance Sheet – It tells about the assets and liabilities of the company.

- Cash Flow Statement – It tells how much of the actual cash is being generated or spent by the company in a given financial year.

- Retained Earnings Statement– This tells changes in equity and shows the changes in a company’s shareholders’ equity over time.

What is an Income Statement?

An Income Statement is a financial statement that provides a summary of a company’s revenues, expenses, and net income over a specific period of time.

Analogy: It is similar to your personal budget.

An Income Statement typically includes the following information for a particular period of time.

- Revenues: The total amount of money earned by the business from its operations, such as sales revenue.

- Cost of Goods Sold (COGS): The direct costs incurred in producing the products, such as materials, labor, etc.

- Gross Profit: The difference between the company’s revenues and its cost of goods sold.

- Operating Expenses: The indirect costs associated with running the business, such as administrative salaries, rent, utilities, marketing, and other general expenses.

- Net Income: The final profit or loss earned by the company during the period, which is calculated by subtracting all expenses, including taxes, from the company’s total revenues.

An income statement is usually a tabular form of revenue and expenditure of the company which shows net income made or net loss incurred during the year.

Let us go back to George’s Burger Joint.

Income Statement of Burger Joint

For the year ended 2023

| Particulars | Amount |

| Sales Revenue | $190000 |

| COGS

Cost of Raw Materials |

$12000 |

| Operating Expenses

Rent & Electricity Salary of Staffs Salary of Manager Equipment |

$12000$12000

$24000 $20000 |

| Gross Income

Tax |

$110000

$10000 |

| Net Income | $100000 |

What is a Balance Sheet?

A balance sheet is a financial statement that provides a snapshot of a company’s assets and liabilities at a specific point in time (specific date).

Analogy: It is similar to your net worth.

Let us understand this also with the example of Burger Joint.

Suppose George decided to sell his business. It means he will sell his assets and pay for his liabilities. The balance amount will be his net capital employed (equity) in the company.

Owners’ Equity = Assets – Liabilities

| Balance Sheet |

| Asset

Cash: $100000 Inventory: $20000 Equipments: $20000 Total Assets: $140,000 Liabilities Account Payable: $40000 George Equity: 100000 |

| Total Equity= 100,000 |

What is a Cash Flow Statement?

A cash flow statement is a financial statement that shows the inflow and outflow of cash in a business over a specific period of time.

Analogy: It is similar to your checking account statement.

This only includes cash-based transactions. Simply put, it shows how much cash is received versus how much cash is used in different activities throughout the year.

The cash flow statement is divided into three main sections:

1. Operating Activities

This includes cash flows related to the company’s primary operations, such as sales revenue. It also includes changes in working capital, such as accounts receivable, accounts payable, and inventory in a specific period of time(quarter or year).

Positive cash flows indicate that the company’s core business generates cash from its operations.

Negative cash flows indicate the company has trouble generating sufficient cash to fund its operations.

2. Investing Activities

It is cash spent or earned on long-term assets such as property and equipment.

A negative value (cash paid) indicates the company invests in long-term assets like buying property or equipment

A positive value (cash earned) indicates the company is selling long-term assets to generate cash flow.

Example

If a company sold a manufacturing plant for $100,000, it would generate a cash inflow of $100,000 in the investing activities section. While this would increase the company’s annual income, it might not be a good sign for long-term health if it sells its assets to generate cash.

On the other hand, if a company buys assets, it might decrease the cash flow, but it will be added to the assets.

3. Financing Activities

This includes cash flows related to the company’s financing activities, such as the issuance of debt and equity, the payment of dividends, and the repayment of loans in a specific period of time(quarter or year).

Some key takeaways from the financing activities section include

- Changes in debt: This section reports the amount of debt the company has taken on or paid off during the reporting period.

- Changes in equity: The financing activities section also reports changes in the company’s equity, such as the issuance or repurchase of common stock or payment of dividends to shareholders.

- Dividends: If a company pays dividends to its shareholders, this will be reflected in the financing activities section.

Key takeaways

While accounting may not be the most exciting subject for some people, it is an essential skill for anyone who wants to invest their life savings in a company.